Current net worth: 48 years worth of expenses. Annual withdrawal rate: 2.1%

Not much to report since the last update… we only had so many, that is one, car to sell, although I might lose my cell-phone virginity soon given that prices have come down to $36/year… all that’s needed to pay that is 25 shares in T and the expense will be covered with dividends… but I digress.

The job is proceeding nicely. It’s good to be back in the numbers game. In that regard, I found the ideal website for recovering scientists. It’s hard to believe, but it’s actually possible to do real science without having to attend meetings, write proposals, and publish four similar papers each year. Even better, the projects come with clean data and possible cash prizes. It’s called kaggle. Go check it out. You’ll fall in love.

I forget whether I mentioned it previously on one of these updates or whether I just pointed it out in the forums, but this year has seen a remarkably large number of forum participants reaching the crossover point of financial independence. Coincidentally, perhaps, ERE started 5 years ago, so I guess it’s about time to graduate.

This leads me to the point [of this post], I really wanted to share (although I shared it on the the ERE facebook page a while ago).

One of the beautiful things about ERE is that the plan, which can effectively summarized as 1) Reduce expenses a lot. 2) Save and invest a lot of money. 3) Do this for 5-10 years. 4) Live of the investment income for the rest of one’s life, depends on math. It is therefore quite robust and predictable.

Compare to other plans for financial independence, which go something like this: 1) Realize that working sucks. 2) Development a magic concept. 3) Earn millions of dollars, which is, at least, somewhat unpredictable in its outcome.

Recently, I was playing around with a spreadsheet trying to understand why there’s such a huge difference in individual wealth once different people achieve past the early years. That is, if we looking at 30+ year-olds, how come some have so much more money than others?

Superficially, the common assumption is that some just earn more, but that’s not the whole story.

Consider the following thought experiment with five different people. Let’s call them Ann, Bob, Carol, Dennis One, and Dennis Two.

Ann decides to go full force on ERE. Earning $25,000 per year, she finds a cheap and local place to live, sells the car, replaces the TV with useful hobbies and home-production, starts thinking in of possessions in terms of depreciation/rent and generally does everything right. After four to six years, she now has $100,000 saved up (along with a bunch of kick-ass self-reliance skills, etc.).

Bob thinks that full-ERE is a “bit extreme” and decides to pick and choose whatever seems good. Bob downsizes his apartment but keeps the car. He gets rid of the TV but still spends $200/month on socializing. After four to six years, Bob has $50,000 saved up.

Carol follows traditional (YOLO?) advice. She “lives in the moment” and spends what she earns in order to enjoy life. She plans to start saving later once she gets a good job. For her, frugality is synonymous with sacrifice. She books annual vacations; has a cell phone which is less than 6 months old and recently bought a car. She is perhaps a bit unusual in the sense that she refused to finance her car. She also pays off her credit card in full every month. After four to six years, she still have a bank account with zero dollars on it.

Dennis One has three credit cards. All of them have an outstanding amount, for Dennis is building credit. He also has as much house as the bank would let him he recently financed his third car in five years. Dennis One doesn’t live above his means. Rather he lives exactly at his means, sort of. Since he doesn’t save anything, big purchases are always financed. This included the student loan Dennis signed up for because the rate he was offered was too good to pass on (compared to his credit cards). The result of this is that Dennis now carries $50,000 in debt.

Dennis Two is a more extreme version of Dennis One. Their outward appearance seem very similar. The only difference is that Dennis Two is a bit older and perhaps have been a bit more aggressive in terms of taking loans. Also Dennis Two went to an expensive private college. As a result, Dennis Two carries $75,000 in debt.

Now for the thought experiment. Lets from now on assume (perhaps a bit unrealistically) that right after they accumulate these amounts, all five start living exactly the same way. Lets assume that those with savings invest and get a 6% return. Lets also assume that those with debt pay 6% in interest. Lets assume they all spend everything they make except $5000. Those with positive networth save the money. The others put it towards their debt.

In other words, for the sake of the argument, they live exactly the same lifestyle spending exactly the same. The only difference is that Ann starts with $100,000, Bob starts with $50,000, Carol starts with nothing, and Dennis starts being $50,000 and $100,000 in debt respectively.

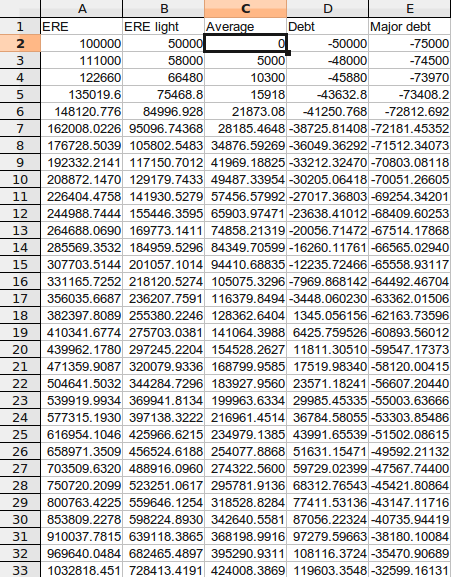

I have calculated the annual results in the spreadsheet below.

After some years, the difference is astounding. People often talk about the “magic of compound interest”. This is technically what’s going on here. However, there are aspects which are MUCH more powerful than compound interest, namely

1) A head start is awesome! Anyone who has done some compound interest calculations notice that at first nothing seems to happen. Then once you’re 60-80 years old, the numbers suddenly explode. But then again, what’s the use of such large sums of money when the activity level is materially on the decline?

An extreme savings program like ERE serves to catapult those who adopt it a few decades into the future allowing one’s networth to explode in one’s late 30s, 40s and 50s. This is what happens in columns 1 and 2.

2) A late start is brutal! Starting with debt is absolutely crushing in terms of long term performance. I used to think of it in terms of headwinds and tailwinds. Imagine you’re at a race. However, not everybody starts at the same starting line. This is a race that involves a hill. Those who start ahead gets to start part way down the hill and starts running down. Those who start a zero gets to start at the top and run down. But those who start behind first have to run up the hill before they can even begin. Huge disadvantage.

I’m reminded of last year’s Great Vallejo Yacht Race, where I was the mainsail trimmer on a J/105. I remember us spending more than an hour trying to get through/under the Richmond bridge. The reason was that the outgoing tide was so strong as to complement counter any propulsion we had from the sails. So imagine twenty some boats just going back and forth between Red Rock and Richmond spending 10 minutes per pass just to gain a foot against the current. That was a lot of work just to get

nowhere. This is what being heavily in debt must feel like. Paying and paying and never really getting anywhere. Fortunately, there is a way out: An extreme increase in payments. Essentially, one must do what Ann did for a few years and save practically all one’s income in order to eliminate the countercurrent money drain.

Of course due to the inertia of habits it rarely works out like this. While the math is unstoppable, people resist change, often to a great irrational extent. It is probably unlikely for Ann to buy a car so she can drive 1 mile to get groceries when she’s used to picking food up on the way home. Or get a $150 cable subscription just to waste time watching TV when she’s used to doing more interesting stuff by now. Or spend $8000 on a two-week vacation when she spent 3 months last year traveling around the world travel-ninja-style for a total of $800. Likewise, it’s unlikely that Dennis will suddenly “get religion” and go ERE in order to ditch his enormous debt.

So realistically, Ann and Bob will be much richer than predicted above. Carol will be somewhat poorer than predicted. And Dennis will probably struggle with his debt until he is a very old man.