The two prevalent numbers for the middle class are net worth and credit score. These numbers are, however, not very useful if you wish to retire very early. Credit score measures your ability to take on debt and be obligated to work for others, and net worth says very little about how well your money is actually working for you. For instance, I did not start a credit history until 2006 and I did not start a tax-advantaged retirement plan until 2007. Both happened after I got financially independent.

To properly evaluate an early retirement approach e.g. an approach that does not involve 30 years of working and paying off bills, other numbers must be optimized.

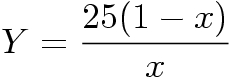

The first number is the savings power.

Here x is your savings rate. For standardization, it is easiest if x is your after-tax rate. The lower Y is, the better. Numbers below 15 are pretty good. Extreme numbers are single digit. A high savings power eventually establishes a high current ratio. Therefore you must first focus on increasing savings power.

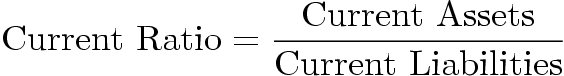

The second number is current ratio.

Current assets are the liquidation value of all your assets. It is the value of your cash + the market value of your securities + the market value of your retirement plans (minus early withdrawal penalty) + anything else you will be able to sell within a year. Current liabilities are any kind of expenses you will incur within the next year such as cost of living, debt repayment, interest payments, and so on.

If you have a double digit Current Ratio you are on your way to early retirement. If you are still in the single digits, you are still looking to work for at a decade or more. Early retirement becomes a possibility once the current ratio exceeds 25.

The third and last number is cash flow. Cash flow becomes important once the current ratio is satisfied. Fortunately, there are many financial instruments that can easily be used to generate cash. Dividend yielding stocks is my favorite, but stock liquidation is also a possibility. Another possibility is REITs or simply owning land directly.

It may be wise to start setting up your cash flow some time prior to early retirement, both to get a proof of concept, but also to avoid discontinuously rearranging your assets which would result in capital gains taxes, etc.

Originally posted 2008-09-02 07:45:06.