Below is a guest post from rePete arguing that optimal budget solution follows a Pareto law. This means focusing mainly on housing and transportation. Terhorst spent an entire book trying to convince us that if only we’re willing to reconsider our attitude towards these two items a great many of us could retire on what we already have in terms of savings. And he’s essentially right! Interestingly enough, housing and cars are two consumer objects which have been almost completely financialized meaning that instead of thinking of it as a $25000 car, people now think of it as a $250/month car. This has skewed supply and demand and consequently, housing and transportation are significantly more expensive than 50 years ago. If you want to significantly reduce your budget, just say no! The third category is food. In 2011 I’ll attempt to grow a substantial part of my own food using square foot gardening.

On this blog, Jacob wrote “many are very efficient at making money but hopelessly inefficient at spending money.” From that concept, I think it is interesting to flip the audience around a bit. Namely, change the readers from consumers to employees who manage their personal finance business, a home economist if you will. Then if it is true that we are efficient at our money-making skills, we should be able to leverage our highly skilled tactics to have the same effectiveness in our personal lives.

Below are visualizations of personal expenses, which encourage the employed to make a few simple changes to allow a much faster retirement ability. The answers, of course, are still in the blog.

In Western society, there is already a focus on increasing our income. The ERE blog, along with this writing, focus on the alternative method to increase wealth; that is increase wealth by decreasing expenses. This post uses generic industry problem solving tools to take a high level view of average consumer expenses. For the sake of efficiency, I will try to make the largest amount of impact with the least amount of effort.

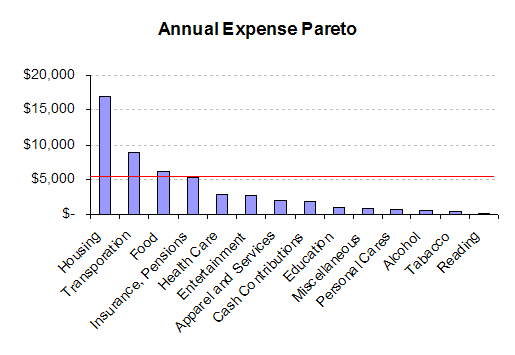

Here is the average current $49,638 annual household expenses, in a more typical format.

Before the start of the long tail, the Pareto line makes a break after the third or fourth item. Since the fourth item, Insurance and Pensions, is both needed and an investment for the future, respectively, the Pareto line is just as easily placed after the first three items — Housing, Transportation, and Food.

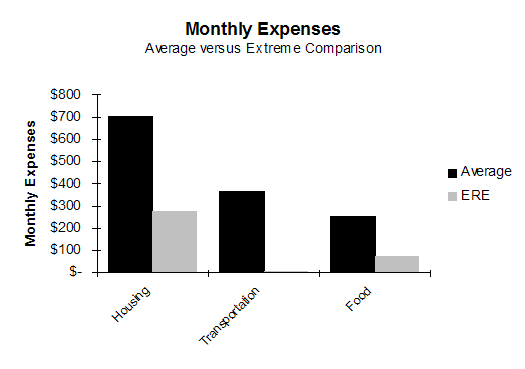

Following the Pareto rule, we stand to make 80% of all possible reductions in the amount of capital needed for retirement, if focus is on those 3 items, which is roughly 20% of the total 14 items. Following the ERE industry comparison in the 21-day makeover for housing, food, and transportation, there is in fact a large room for improvement.*

*Note that $49,638 visualeconomics data is the expenses for 2.5 people. I assume there are 2 wage earners and normalized that data to 1 person for equal comparison to the ERE numbers which are found typically in terms of 1 person.

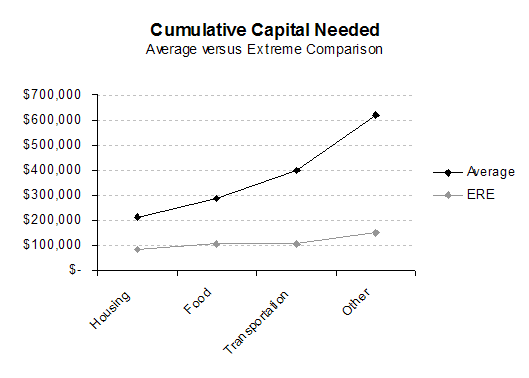

Furthermore assuming a 4% safe withdrawal for the capital needed to retire, the differences between the current and the industry standard are now quite obvious.

If those changes alone are taken to down to the entitlement ERE standard, the capital needed reduces by roughly half as much capital! The time until retirement now drastically decreases since not only is less accumulated savings required but the capital accumulates faster as the savings rate has increased.

These are the high level changes that should continuously be part of the home economists’ vision to keep the operating expenses low. After these heavy hitters are lowered, these economists should then explore expenses in the Other category that could possibly help reduce expenses more.

Originally posted 2011-01-11 18:45:28.