If you're new here, this blog will give you the tools to become financially independent in 5 years on a median salary. The wiki page gives a good summary of the principles of the strategy. The key to success is to run your personal finances much like a business, thinking about assets and inventory and focusing on efficiency and value for money. Not just any business but a business that's flexible, agile, and adaptable. Conversely most consumers run their personal finances like an inflexible money-losing anti-business always in danger of losing their jobs.

Here's almost a thousand online journals from people, who are following the ERE strategy tailored to their particular situation (age, children, location, education, goals, ...). Increasing their savings from the usual 5-15% of their income to tens of thousands of dollars each year or typically 40-80% of their income, many accumulate six-figure net-worths within a few years.

Since everybody's situation is different (age, education, location, children, goals, ...) I suggest only spending a brief moment on this blog, which can be thought of as my personal journal, before looking for the crowd's wisdom for your particular situation in the forum journals.

If you enjoy the blog, also consider the book which is much better organized and more complete. You can read the first chapter for free, listen to the preamble, or see the reviews (1,2,3,4,5,6,7,8,9, A,B,C,D,E,F,G,H,I,J,K,L,M,N,O,P,Q,R,S,T,U,V,W,Z). Subscribe to the blog via email or RSS. Get updates on the facebook page, join the forums, and look for tactics on the ERE wiki. Here's a list of all the ERE blog posts.

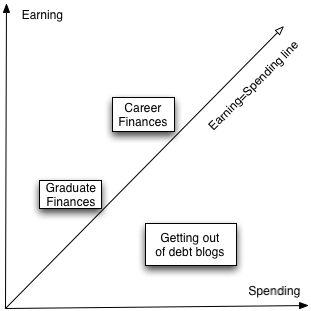

Personal finance blogs primarily fall in three major categories. First, there are the “getting out of debt” blogs. Second, there are the “just got out of college” personal finance blogs. Third, there are the “career track” personal finance blogs. Of course there are more categories such as retirement blogs or I-won-the-lottery blogs, but these are the biggest.

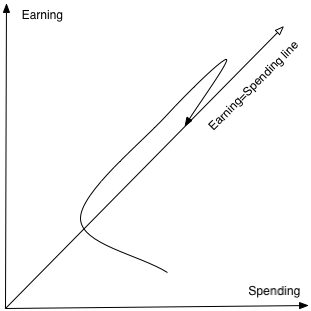

Drawn below is a graph depicting this triad.

The x-axis shows spending. The y-axis shows earning. The diagonal line shows where earnings are equal to spending. Those who are in debt have been spending more than they have been earning and thus they lie below the diagonal line. “Graduates” (young people) have low earnings but hopefully also low spending. At that point in life there is a tendency to spend as much as one earns since earnings are relatively low.

The major group is what I for lack of a better word call the career track blogs. Here spending is 15% below earnings. This track is continued for 30-40 years as earnings and spending get progressively higher as a roughly constant margin for the retirement plan is retained. Since one particular blog shows a snapshot in time of a person’s finances, plotting all the bloggers at one time reflect

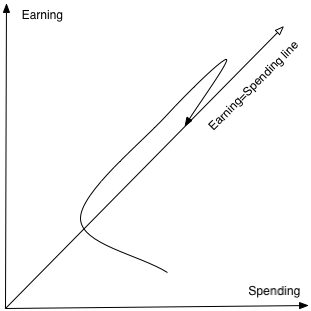

the typical financial path taken by a person in our society. It looks like this. If there are any amateur astronomers reading this just think of the similarities to the typical evolution of a star on a

Hertzsprung-Russell diagram. No, there is no hidden cosmic significance here 😉

A person in this diagram may start in debt or at the spending=earning line. As earnings go up savings are gradually increased to 15% at which point they are held constant. As earnings keep going up spending is adjusted accordingly. After 30 or 40 years, the person retires with a modest drop in spending (no cafeteria lunch and no commute).This path is how most people think when it comes to personal finance. Other paths may sound strange or even impossible.Here are some other paths. That hopefully puts everything in perspective.

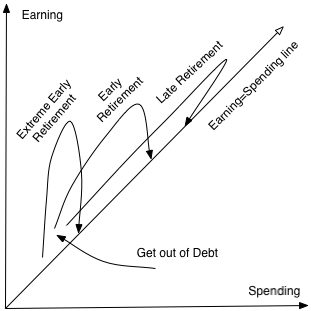

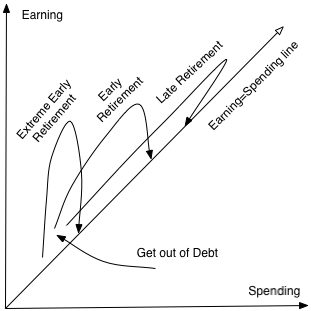

It is seen that the typical path above is just one of several possible path

It is seen that the typical path above is just one of several possible path. The typical path corresponds to going into student debt, then getting a career for 30-40 years eventually paying off the debt and accumulating a large amount of money (ideally 1-2 million dollars in retirement funds) and then

retiring at a high spending level which little concern for how the money is spent.Early retirement can be reached through perhaps modest student debts but saving substantially more at a rate of 30-50% for 15-20 years at which point

early retirement is possible at age 40-50. This does require some budget control to carry through.Extreme early retirement is reachable with even smaller student debts (or perhaps no student debts) and saving 50-80% for 5-10 years.

This makes it possible to retire between ages of 30 and 40. This requires substantial money management and frugality skills.The two conclusions to be drawn here is that by observing a large group of personal finance bloggers one can get an idea of how a person (a blogger to be exact) typically behaves over a lifetime. One the other hand one should also study “strange” blogs to see what other paths are possible.

Originally posted 2008-02-28 07:18:59.