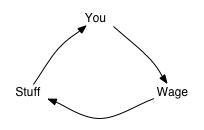

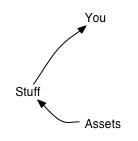

Being poor or unable to get credit 100% of the expenses must be covered with wage income. Schematically the cash flow looks like this

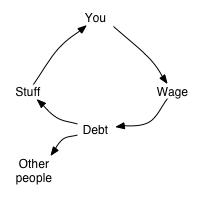

Thus you put your time into your work which gives you a wage income that is used to pay for stuff that goes back to you.People with a credit score can go into debt. Today almost anyone can do this. In this case debt can be use to pay for stuff and the wage can be used to pay for debt such as credit cards, car loans, mortgages, student loans, etc. This is the way most people handle their personal finance. Very few people pay cash anymore and financial success depends on being good at handling debt. Many websites will tell you how to do that.

You will notice that the debt box has a small leak of money that goes to other people. This is the price you pay for debt.

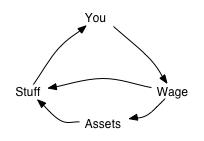

Investors don’t pay other people to use money. They are the other people. If you want to be an investor, you need to build income generating assets. Investing is mainly about escaping the need for a wage income. Initially though other people will not be paying you enough money to cover all your stuff, so your cash flow will look something like this.

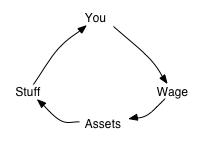

What can I say, I love making diagrams. Note that as soon as you have assets, you start getting an additional cash flow. If you want a larger cash flow, you need more assets. Personally I was so bent on accumulating assets that I reduced the amount of stuff I bought so I could save 75% of my wages.Once you have accumulated a sufficient amount of assets, the cash flow cycle will look like this.

At this point you will be financially independent. This is the stage I am in. My assets pay all my expenses in the form of dividends and interest. In other words, other people pay for my stuff. As I keep adding to my assets, my asset based income grows larger. Since this income is larger than what I spend, the assets can compound exponentially and aid in growing my income.Note that you are only financially independent if your assets can provide you with sufficient cash to cover your “stuff”. It does you no good, if your assets are your house or if they are sitting in a retirement account where they can’t provide income. Of course I could retire in which case my cash flow would look like this.

Notice the absence of a wage income. It is not needed because there will not be any creditors knocking at the door like a few steps above nor will there be any problem in putting food on the table.

Also see

- Advanced cash flow diagrams

- And Section 7.1 in the book which contains a much expanded discussion of these diagrams + additional diagrams. Note that amazon lets you read chapter 1 and a bit of chapter 2 for free in case you’re interested.

Originally posted 2008-01-26 07:30:01.